Thinking about your supply chain solutions

The world is changing at a pace like no other; supply chains are too. Before you decide to change, just check it has longevity and isn’t a knee jerk action to a short-term spike…

Is this the future?

Holding more stock due to your long supply chain drives a bigger warehouse, but in the long term is the better strategy to onshore or shorten the chain? Perhaps adopting technology to be smarter on replenishment and optimum stock levels is the solution. Think carefully before laying down your footprint as it’s pretty hard to unpick a 10-year lease.

If you are planning short-term then get innovative with your solutions… Airbnb showed us that we can use someone else’s space for a short-term solution; applying this concept in the Warehouse world could be your answer. If you are reading this as a business that has seen volume drop consider that you may be the solution to your neighbours’ problem.

Start from perfect but recognise what is ‘good enough’

So, you are through the first hurdle, and it’s time to turn up the heat on your new supply chain. What should you do?

- The word ‘chain’ is incredibly important, every element is connected and you cannot consider a section without considering the whole.

- Don’t be afraid to put costs in to take costs out that are greater; hence why it’s important to realise you are working with a chain.

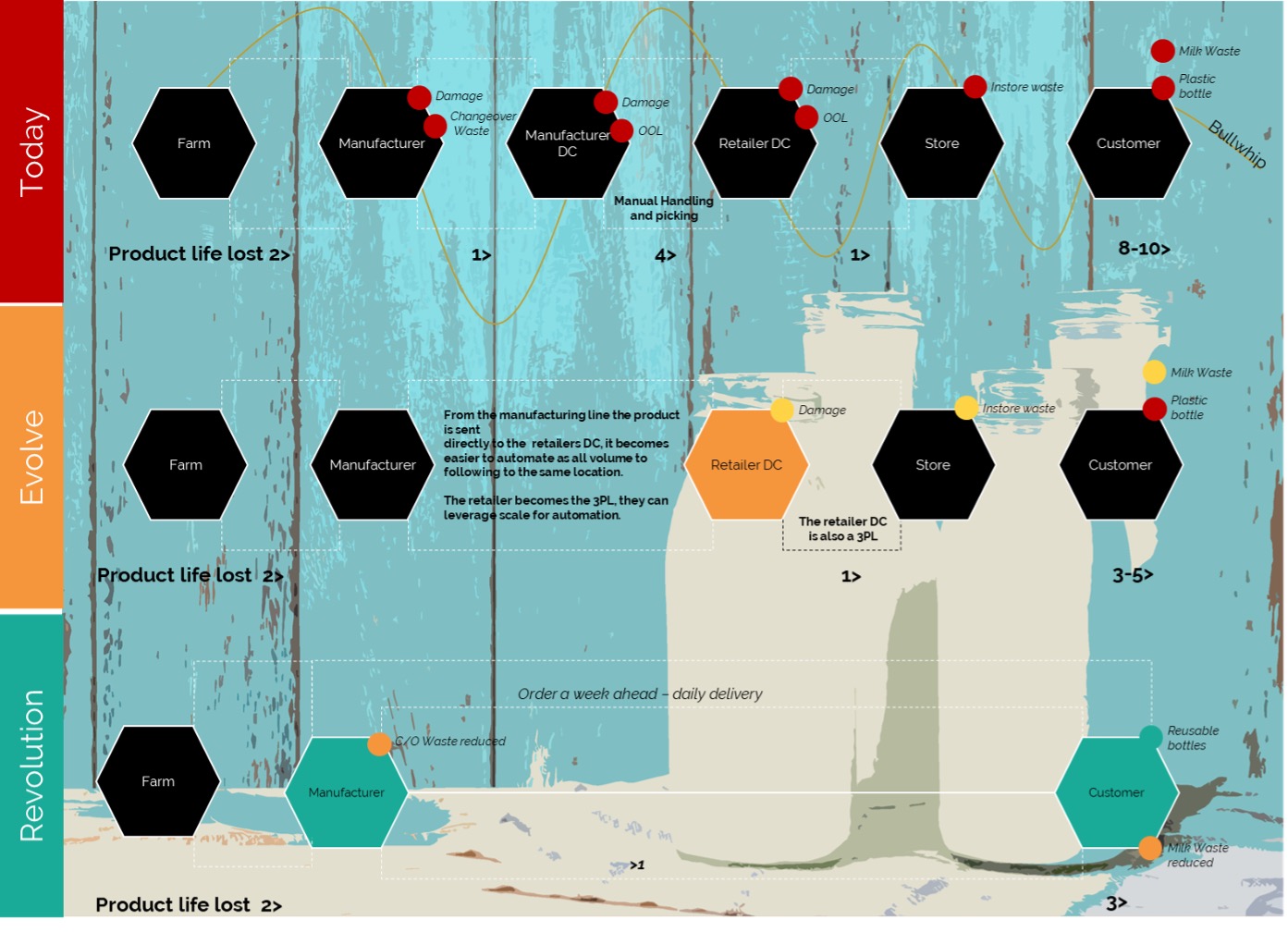

- Consider the costs of others; your suppliers, your customers and how you could put costs into your business that reduce costs or vice versa. A great example is stock; the best place to hold stock is as close to the customer as economically possible. So often we see multiple stock locations which have buffer stocks just to ensure they replenish the next buffer. Consider the example of fresh milk (Figure 1).

- Start with perfect and work backwards. If you had a blank canvas and your volume tomorrow, what would you do? Once this is established, map the art of the possible in moving towards this.

Figure 1: Stock Example

Know your Onions – my favourite English term

Use science, brains and logic. What you change now will be the solution for the future so consider the implications and risks on the changing world. Will your solutions be flexible to respond whilst being lean and a competitive advantage for tomorrow? Automation is the future, but is it your tomorrow?

If you are going to buy a fully automated solution, specification is critical. Under-spec it and you risk buying a “dud” from day one. Over-spec it and the business case might not stack up. Most importantly, you might have over-capitalised. Most businesses therefore play too safe and over-spend.

We have seen multi-million-dollar projects where the specification and design is based on a rudimental calculation to work out depth of racking and the number of robots based from safe averages. That business now has an automated warehouse that is running at about 60% utilisation yet has some products that will not work and are stored in a 3PL.

Be flexible in design. Consider blending solutions and most importantly, model the sh*t out of your design using real numbers and proper maths. Using a digital twin and simulating the real-world volume and constraints will give you confidence before you sink $40m when $25m would do.

Gatekeeper turned Poacher

Make sure the partners you choose are working in your best interests. Are they willing to advise the best solution or are they incentivised on selling you the new and shiny.

Build for what you need now and next, not for 10 years – no matter the cost reduction. Countless times we see businesses invest “now” believing it will cost less in a fancy cashflow model; these are often built on either aspirational growth curves or more importantly because money is cheap!

What you do need to consider is future proofing the growth opportunity. Land is sensible, but an oversized shed or automation solution is not; these things are modular and can easily be extended.

Deploying capital now that doesn’t start payback until year Five is just silly! Think about deploying that capital on a payback project (3 year) that starts tomorrow and by the time you get to year Five you will have raised the cash entirely to fund that extension -basically for free even if it costs 20% premium!

Paul Eastwood; CEO & Founder – Pollen Consulting Group